Introduction

With more than 70% of trades in the crypto market influenced by technical analysis, understanding crypto candle patterns for trading is pivotal. These patterns serve as a visual representation of price movements, enabling traders to predict future price action. According to recent statistics, a staggering $4.1 billion was lost to hacks in DeFi throughout 2024, making it crucial for traders to enhance their strategies, including their analysis methods.

The Importance of Candle Patterns

Candle patterns, or candlestick formations, are vital for traders looking to gauge market sentiment. They help in determining key points of price reversal and continuation. Here are some basic components of a candlestick:

- Open price: The price at which the asset starts trading within a particular timeframe.

- Close price: The price at which the asset finishes trading.

- High price: The highest price the asset reaches during the timeframe.

- Low price: The lowest price the asset dips to during the timeframe.

How to Read Candle Patterns

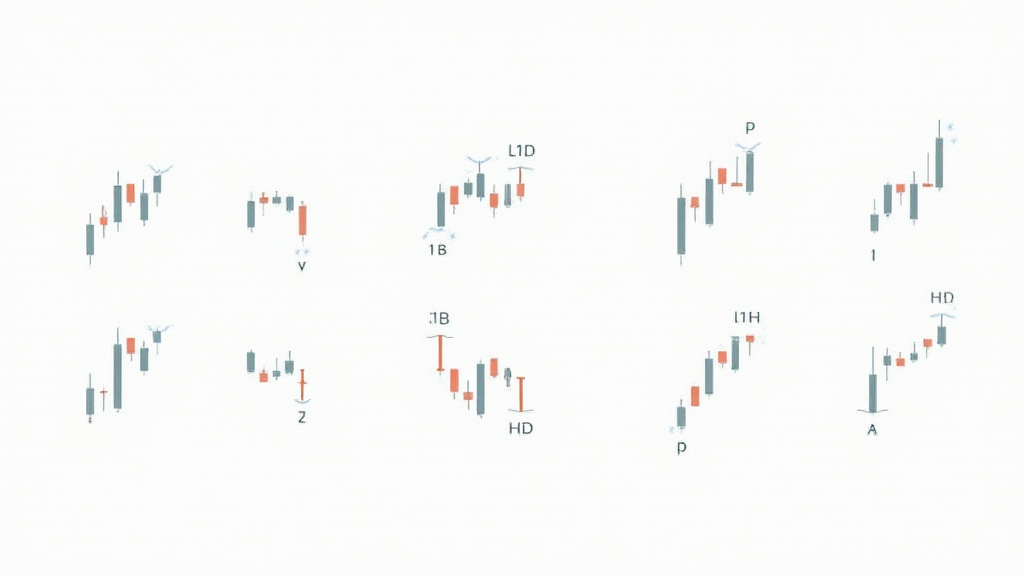

Reading candle patterns requires an understanding of market psychology. Here’s a breakdown of common patterns:

- Doji: Indicates indecision in the market.

- Hammer: Signifies a potential bullish reversal.

- Shooting Star: Points to a potential bearish reversal.

Common Candle Patterns and Their Implications

Let’s explore some popular candle patterns along with their implications:

1. Bullish Engulfing Pattern

This pattern emerges when a larger green candle engulfs the previous red candle. It suggests strong buying pressure; hence, it can be a signal to enter a long position.

2. Bearish Engulfing Pattern

Opposite to the bullish pattern, this occurs when a red candle engulfs a preceding green candle. It indicates growing selling pressure, often suggesting a potential drop in price.

3. Morning Star and Evening Star

The morning star is a bullish pattern following a downtrend, while the evening star is a bearish pattern after an uptrend. Both patterns are indicators of potential reversals.

Candle Patterns in the Vietnamese Market

As of 2023, Vietnam has witnessed a remarkable growth rate of over 200% in crypto adoption. Understanding how to tactically employ crypto candle patterns for trading is crucial not just for experienced traders but also for newcomers eager to join this fast-paced market. This increasing interest in technical analysis tools, including candle patterns, is on the rise among Vietnamese users.

Applying Candle Patterns to Trading Strategies

To capitalize on candle patterns effectively, traders often integrate them into broader trading strategies. Here’s a simple approach:

- Identify Key Levels: Look for support and resistance levels where candle patterns form.

- Wait for Confirmation: Always confirm patterns with additional technical indicators, like moving averages.

- Manage Risk: Use stop-loss orders to protect your capital from unexpected market movements.

Final Thoughts on Crypto Candle Patterns

In the world of trading, the significance of mastering crypto candle patterns for trading cannot be overstated. They provide valuable insights that go beyond mere numbers, reflecting the incessant ebb and flow of market psychology. With Vietnam’s crypto landscape evolving rapidly, staying updated with effective strategies and analytical tools such as candle patterns is essential.

Remember, trading involves risk—always conduct due diligence and consider consulting local financial regulators for guidance. A deep understanding of these patterns can serve as a powerful addition to your trading arsenal, potentially improving your success rate significantly.

Expertise Behind the Insights

Written by Dr. Richard Tran, a blockchain analyst who has published over 20 papers in the field and led notable audits for prestigious projects. His expertise lies in technical analysis and market forecasting.