Understanding Crypto Market Sentiment Indicators

As the digital asset landscape continues to evolve, the importance of

1. What Are Crypto Market Sentiment Indicators?

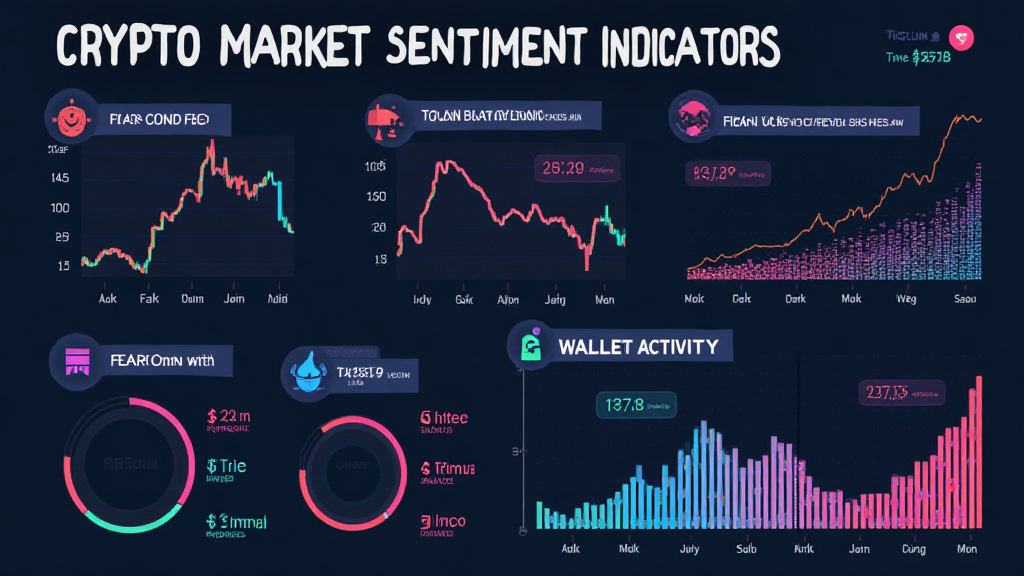

Crypto market sentiment indicators refer to metrics and tools that gauge the mood of the market—whether it is bullish (optimistic) or bearish (pessimistic). These indicators help traders and investors to make more informed decisions based on collective psychological behavior rather than just technical analysis.

ong>Social Media Sentiment: ong> Analyzing comments, posts, and shares across platforms such as Twitter, Reddit, and Telegram can reveal the public’s attitude towards specific cryptocurrencies.ong>Fear and Greed Index: ong> A quantifiable metric that represents the level of fear or greed within a market.ong>Google Trends: ong> Exploring how often certain crypto-related terms are searched can provide insights into rising interest or concern.

2. Why Is Market Sentiment Important?

Understanding market sentiment is crucial because it often serves as a precursor to price movement. For instance, during a surge of optimism (greed), you may observe a rapid increase in buying pressure. Conversely, fear can lead to panic selling. Hence, having the right sentiment indicators allows one to align their strategies accordingly.

Case Study: Vietnamese Market Trends

According to recent statistics, Vietnam has experienced a 35% year-on-year increase in crypto users in 2024, making it one of the fastest-growing markets globally. As interest grows, so does the impact of market sentiment on pricing dynamics in the region.

Utilizing Sentiment Indicators

Here’s the catch: While understanding sentiment is beneficial, relying solely on it can lead to pitfalls. It should be seen as a piece of the puzzle. Incorporating market sentiment into an already structured analysis plan can yield better results.

3. Key Sentiment Indicators to Watch

Several indicators can enhance your understanding of market sentiment.

ong>Sentiment Scores: ong> Custom algorithms that score sentiment based on social media data.ong>Wallet Activity: ong> Monitoring the inflow and outflow of digital assets can illustrate how investors feel about their holdings.ong>News Analysis: ong> Reacting to news feeds—both positive and negative—can provide clues on changing sentiments.

4. Challenges in Interpreting Sentiment

While market sentiment indicators are valuable, they do come with challenges. Misinterpretation can lead brokers astray due to:

ong>Noise: ong> Social media can have misleading narratives.ong>Event-driven Changes: ong> Major events can skew public sentiment temporarily.

Tools for Analyzing Sentiment

Tools such as Crunchbase and Hibt.com offer insights into market trends, allowing for a more comprehensive analysis of sentiment. They aggregate data to display the current mood of the crypto community effectively.

5. Conclusion: Staying Ahead in the Crypto Trading Game

In the fast-paced world of digital finance, understanding

In summary, utilizing sentiment indicators is analogous to having a compass in a foggy environment; they do not provide the entire roadmap but can guide you in the right direction. Make sure to combine sentiments with fundamental and technical analyses for optimized decision-making.

For more insights and amendments to your crypto strategy, visit pinaycoinlaundry

Author: Dr. Anh Nguyen, a blockchain strategist with over 10 publications in the field of digital assets and an auditor for leading projects like DeFi Chain-Audit.