Technical Analysis for Crypto Beginners: A Comprehensive Guide

With over $4.1B lost to DeFi hacks in 2024, understanding the financial intricacies of the crypto market has never been more essential. As a beginner, navigating technical analysis can feel overwhelming, but fear not. This article will simplify technical analysis for you, empowering your journey into crypto trading.

Understanding Technical Analysis

Technical analysis involves analyzing market data, primarily price and volume, to forecast future price movements. It’s akin to a bank vault for digital assets: it’s essential for safeguarding your investments.

Key Components of Technical Analysis

- Trends: Identifying upward, downward, and sideways trends.

- Support and Resistance: Key price levels that typically attract buying or selling.

- Charts: Visual tools that represent price movements over time.

- Indicators: Statistical measures that help to predict future price movements.

According to recent studies, 75% of successful traders rely on these components. As a beginner, mastering these will put you on the right path.

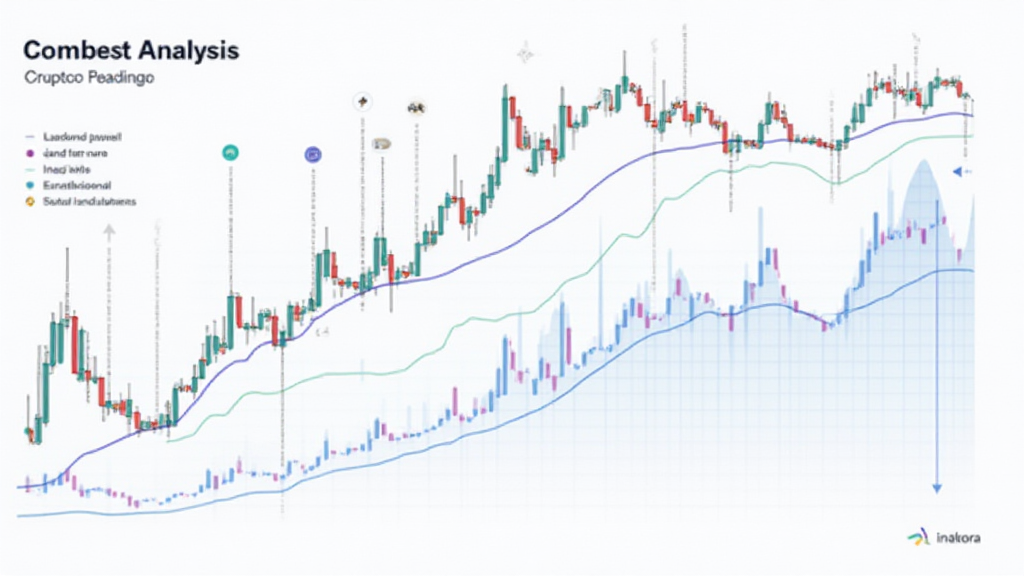

Using Candlestick Charts

Candlestick charts are one of the most popular methods of visualizing price movements. Each candlestick provides information about the open, high, low, and close price in a specific time frame.

Types of Candlestick Patterns

- Bullish Engulfing: Indicates potential price increases.

- Bearish Engulfing: Suggests a price decline.

- Doji: Signifies indecision among traders.

Understanding these patterns will significantly enhance your ability to predict market movements.

Common Technical Indicators

Indicators are crucial tools for technical analysis. They help traders gauge market sentiment and identify potential entry and exit points.

Popular Indicators for Beginners

- Moving Averages: Smooth out price data to identify trends over a specified period.

- RSI (Relative Strength Index): Measures momentum by comparing the size of recent gains to recent losses.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages of a security’s price.

By incorporating these indicators into your analysis, you’ll increase your odds of making informed trading decisions.

Chart Patterns to Watch For

Chart patterns are another essential aspect of technical analysis. They illustrate the actions of traders and can indicate future market conditions.

Useful Chart Patterns

- Head and Shoulders: Often a sign of reversal.

- Triangles: Indicates continuation of the trend.

- Flags: Suggest a strong trend continuation.

Learning to recognize these chart patterns can make a significant difference in your trading strategy.

The Importance of Risk Management

Successful trading isn’t just about making profits; it’s also about managing losses. Risk management is crucial for long-term survival in the crypto market.

Basic Strategies for Risk Management

- Position Sizing: Determine how much to invest based on your risk tolerance.

- Stop-Loss Orders: Set up automatic selling of assets to minimize losses.

- Diversification: Reduce risk by investing in different assets.

Implementing these risk management strategies can help protect your investments amid the volatility of the crypto market.

Real-World Application of Technical Analysis

To illustrate the effectiveness of technical analysis, let’s consider a case study.

Case Study: Bitcoin During 2025 Market Fluctuations

In 2025, Bitcoin saw significant fluctuations. Those who employed technical analysis were able to predict potential resistance levels and make informed trading decisions.

For example, when Bitcoin hit a support level at $30,000, those with knowledge of technical indicators were prepared to buy, leading to substantial profits as it rebounded above $40,000.

Future Trends in Technical Analysis

Looking ahead, the integration of AI and machine learning in technical analysis is set to revolutionize trading strategies.

Expected Changes by 2026

- Enhanced Predictive Models: AI will offer more accurate predictions based on larger datasets.

- Automated Trading: Algorithms will execute trades based on predefined conditions.

- Greater Accessibility: More tools available for beginners through user-friendly platforms.

As the crypto market evolves, staying updated with these trends will improve your trading success.

Conclusion

Technical analysis for crypto beginners is a powerful tool that can enhance your trading success. By understanding market trends, utilizing candlestick charts, and applying indicators, you can navigate the complexities of cryptocurrency trading with confidence. Remember, practice makes perfect, so engage with real data and start analyzing today!

For further resources, consider visiting hibt.com which provides valuable insights on technical analysis.

Embrace the roadmap laid out in this guide to become proficient in technical analysis and elevate your trading skills. Not financial advice, consult local regulators before investing.

For more insights related to trading and investments, check out our Vietnam crypto tax guide.

Lastly, if you’re considering crypto laundry services, visit pinaycoinlaundry for secure transactions.

Written by Alexis Tran, a blockchain expert with over 15 published papers and a lead auditor for numerous well-known projects related to security standards in digital assets.