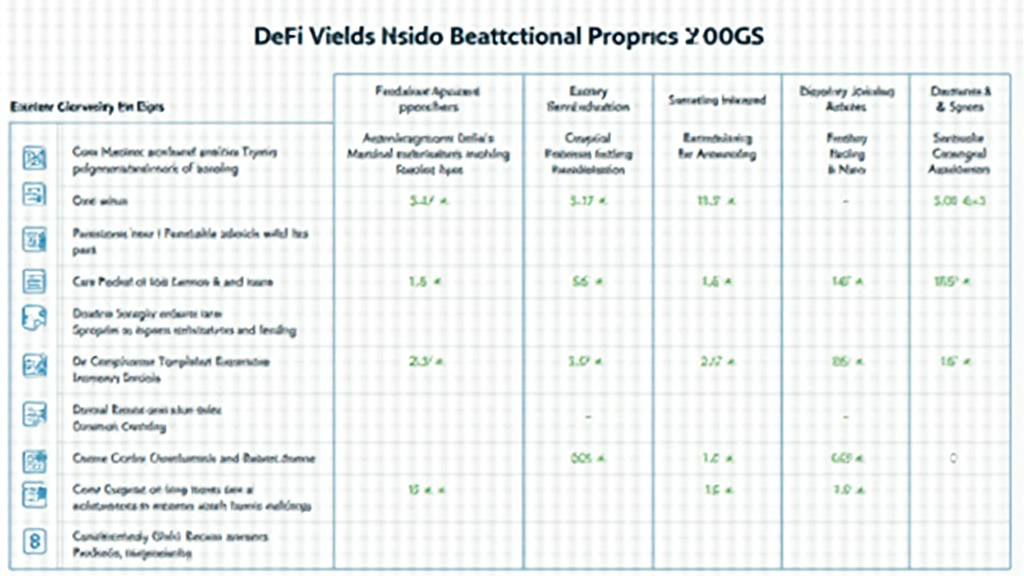

Exploring DeFi Yield Opportunities in 2026

With the DeFi sector rapidly evolving, it’s crucial to explore the

The Growth of DeFi: What to Expect in 2026

As we approach 2026, we can expect exponential growth in the DeFi sector. The total value locked (TVL) in DeFi has consistently increased, with Vietnam’s market also thriving. Recent data indicates a significant

Understanding Yield Opportunities

Here’s the catch: not all yield opportunities are created equal. Let’s break down the various avenues:

ong>Liquidity Mining: ong> Reward systems for providing liquidity to decentralized exchanges (DEXs).ong>Staking Rewards: ong> A method to earn rewards by holding certain cryptocurrencies.ong>Yield Farming: ong> A strategy involving multiple DeFi protocols to maximize returns.

Liquidity Mining Explained

Liquidity mining allows users to earn tokens by supplying liquidity to trading pairs. For example, in 2026, protocols like Uniswap and Sushiswap will lead the charge in offering miners lucrative rewards.

Challenges in Liquidity Mining

It’s crucial to understand the

- Impermanent Loss: Temporary loss of funds due to price changes in assets.

- Protocol Vulnerabilities: Smart contracts may be exploited, leading to financial losses.

Staking Rewards: The Safe Bet?

Staking is often viewed as a safer alternative. By holding a currency in a wallet for a specified period, users can earn rewards. In fact, staking could yield returns upwards of 8% APY in well-established protocols.

Decoding Yield Farming

Yield farming involves deploying assets among various platforms to chase the highest interest rates. This can significantly increase the yield but comes with additional risks:

- Smart Contract Audit: It is essential to audit smart contracts before engaging in yield farming.

- Market Volatility: Prices may fluctuate unexpectedly, impacting overall yields.

Key Considerations for 2026

In 2026, consider the following strategies to minimize risk and maximize returns:

- Diversification: Spread investments across-3/”>cross multiple DeFi projects.

- Continuous Research: Stay updated with the latest market trends.

- Pair Selection: Choose stable pairs to mitigate risk.

Security Measures

Security in DeFi is paramount. Implement tight security protocols such as:

- Cold Wallet Storage: Use hardware wallets like Ledger Nano X for secure asset storage.

- Two-Factor Authentication: Add an extra layer of protection to your accounts.

The Future of DeFi: Predictions for 2027

As we look a bit forward, the DeFi landscape will shape up drastically. Here are some predictions:

ong>Reduced Fees: ong> Expect platform fees to lower as competition intensifies.ong>Broader Acceptance: ong> More traditional financial institutions may integrate DeFi solutions.

Conclusion

As the landscape evolves, exploring

For the latest news and updates in the cryptocurrency sector, visit Pinaycoinlaundry.

Written by: Dr. Maria Tan, a blockchain technology expert with over 15 published papers and a lead auditor for various reputable DeFi projects.