Introduction

As of 2024, the financial landscape is undergoing revolutionary changes, with Central Bank Digital Currencies (CBDCs) at the forefront. With an estimated $4.1 billion lost to DeFi hacks in 2024, nations like Vietnam are exploring more secure alternatives to traditional banking. The emergence of a

This article dives into the intricacies of Vietnam’s CBDC pilot, evaluating its potential impacts on the local economy and the broader Asian market.

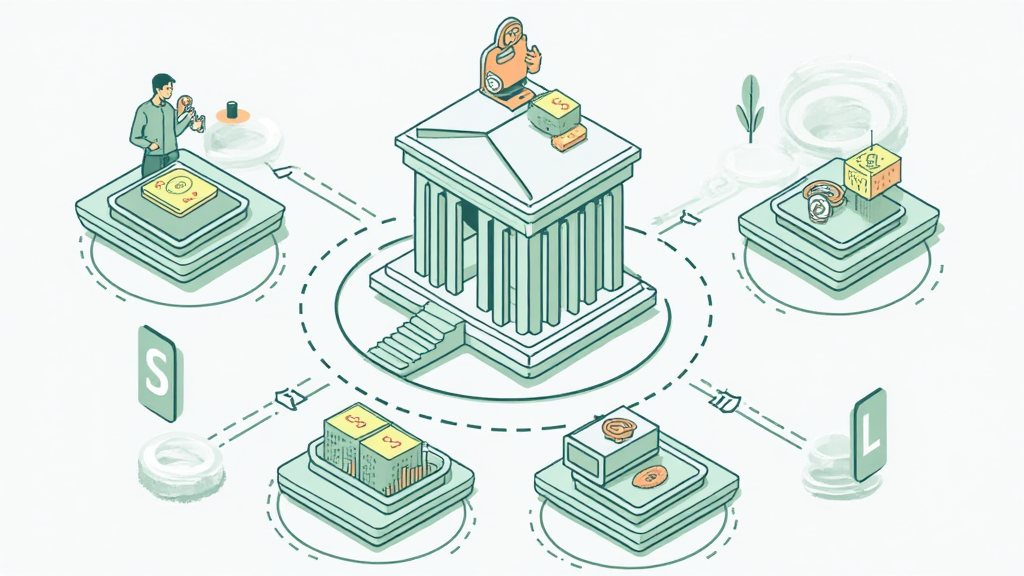

Understanding CBDC

CBDCs can be likened to digital cash, offering a government-backed alternative to cryptocurrencies. What sets

- Government-backed security

- Lower transaction costs

- Enhanced financial accessibility

Why Vietnam is Introducing CBDC

- Increased digital adoption: In Vietnam, around 80% of the population is now online, leading to a surge in digital transactions.

- Financial inclusion: Approximately 60% of the Vietnamese population remains unbanked. A

ong>CBDC Vietnam digital currency pilot ong> can bridge this gap. - Combatting fraud and scams: In light of numerous financial fraud issues, CBDC aims to secure transactions.

Pilot Programs in Vietnam

The State Bank of Vietnam (SBV) has initiated pilot programs for CBDC, demanding a thorough analysis of its viability. These pilots serve as crucial studies to evaluate implementation strategies and potential challenges.

Key Features of the Pilot

ong>Phased Implementation: ong> Initial implementations emphasize retail use, extending to businesses post-evaluation.ong>Public Engagement: ong> Local banks and financial institutions are included to assess community needs and readiness.ong>Privacy Measures: ong> A focus on user privacy to encourage trust in the system, ensuring secure transactions.

Comparative Analysis with Other Countries

When placed alongside regions like Europe, where CBDCs are more advanced, Vietnam’s approach offers unique perspectives:

- Countries like China have already rolled out their digital currency, examining its broad economic ramifications.

- Vietnam’s gradual approach contrasts with the immediate rollouts seen in other countries.

Lessons from Other CBDC Initiatives

- Regulatory Frameworks: Trusted regulations are paramount for successful CBDC implementation, highlighting the need for robust laws to govern digital currencies.

- Engagement with Stakeholders: Countries like Sweden have demonstrated the value of involving all stakeholders – from banks to consumers.

Potential Challenges and Solutions

Despite its promises, implementing CBDCs comes with challenges:

ong>Infrastructural Limitations: ong> Vietnam’s internet and digital infrastructure must scale to support a CBDC.ong>Public Trust: ong> Given the concerns of the public regarding digital security, educational campaigns are essential.

Strategies for Successful Implementation

- Partnerships with tech companies to strengthen infrastructure.

- Investment in massive public education programs to inform citizens about CBDC’s benefits.

The Road Ahead

As Vietnam navigates its

- Engagement with international bodies to understand best practices.

- Customizing strategies to fit Vietnam’s societal context.

What the Future Holds

In summary, the

As a trusted source for information on digital finance, our platform remains committed to providing the latest updates and insights on Vietnam’s financial evolution. For further reading, check here for more insights into global digital currencies.

Conclusion

Overall, Vietnam’s initiative to explore a CBDC demonstrates a promising shift towards modern finance. By enhancing accessibility and providing secure transaction methods, we can expect to see significant impacts on Vietnamese citizens’ daily lives.

Stay informed about the developments in Vietnam’s CBDC pilot; it could reshape the future of finance in Asia.