Introduction

With the global cryptocurrency market reaching a staggering

Understanding Stablecoins

Stablecoins are digital assets designed to maintain a stable value relative to a specific asset, typically fiat currencies like the US dollar. Unlike cryptocurrencies such as Bitcoin, which can experience wild fluctuations, stablecoins aim to provide the benefits of digital currencies with price stability. This stability makes them attractive for various applications, such as remittances, trading, and savings.

The Importance of Regulation

The growing use of stablecoins has prompted governments worldwide to consider how to regulate them. Given that many stablecoins are closely tied to national currencies, their regulation is crucial for ensuring financial stability, combating fraud, and protecting consumers. For example, in Vietnam, the user growth rate for cryptocurrency platforms has surged by

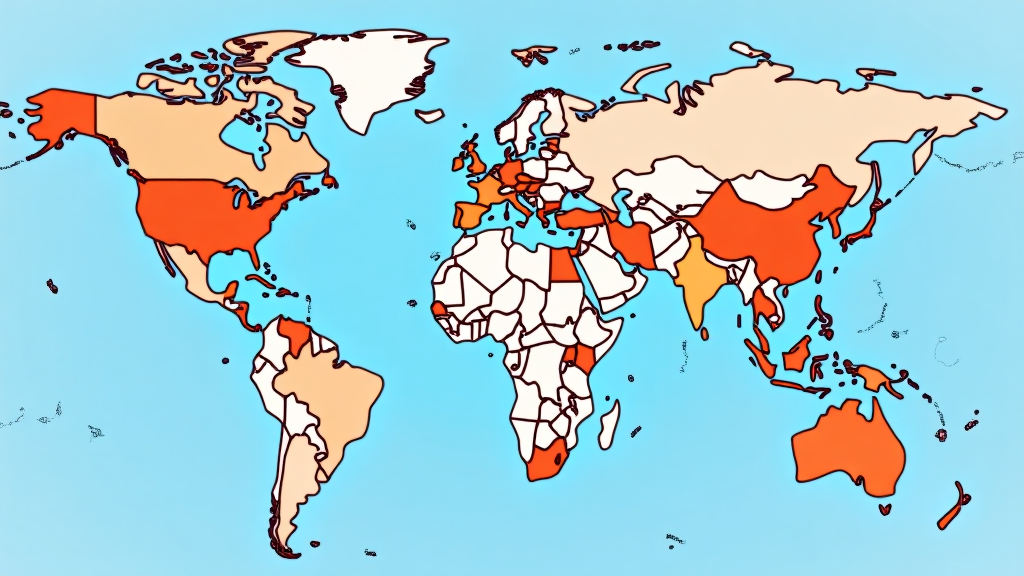

Current Global Regulatory Landscape

Regulatory approaches to stablecoins vary significantly across-3/”>cross regions. Some countries have embraced a proactive stance, while others have adopted a more cautious approach.

ong>United States: ong> The US has been at the forefront of stablecoin regulation, with agencies like the SEC and CFTC seeking to clarify their roles. Theong>Stablecoin Transparency Act ong> aims to enhance consumer protections.ong>European Union: ong> Theong>MiCA (Markets in Crypto-Assets) ong> regulation is currently being finalized. It intends to establish a comprehensive framework for digital assets, including stablecoins, by 2025.ong>Asia: ong> Countries like Singapore and Japan are leading the charge, developing progressive regulations that aim to foster innovation while ensuring consumer safety.

Challenges to Regulation

Despite efforts to regulate stablecoins, several challenges remain:

ong>Decentralization: ong> Unlike traditional financial systems, many stablecoins operate on decentralized blockchains, making regulation challenging.ong>Global Nature: ong> The inherently global nature of cryptocurrencies requires international cooperation, which is difficult to achieve.ong>Technological Complexity: ong> As blockchain technology continues to evolve, regulations need to adapt quickly—an ongoing struggle for authorities.

Case Study: Tether and Regulatory Scrutiny

Tether (USDT) is the largest stablecoin, with a market cap exceeding

Impact on the Market

The scrutiny faced by Tether has implications for the entire stablecoin market. A loss of confidence in USDT could lead to a significant sell-off, affecting liquidity across-3/”>cross the crypto ecosystem.

Future Outlook and Trends

As stablecoin usage continues to grow, we can expect several trends to emerge in 2025 and beyond:

ong>Increased Regulation: ong> Governments will likely implement comprehensive regulations that address consumer protection and financial stability.ong>Enhanced Transparency: ong> The demand for transparency around reserves will lead to more robust auditing and reporting practices.ong>Innovation in Smart Contracts: ong> The rise of decentralized finance (DeFi) will push for the integration of stablecoins into innovative protocols, enhancing their utility.

Conclusion

With increasing scrutiny and evolving regulations, navigating the global landscape of

For those engaging with stablecoins, partnering with reliable platforms ensures security and adherence to regulations. Pinaycoinlaundry is here to provide insights, tools, and a supportive community for navigating the complexities of cryptocurrencies.