Introduction

With over $4.1 billion lost to DeFi hacks in 2024, understanding effective trading techniques like Fibonacci retracement is essential for success in the crypto space. This article aims to unpack the intricacies of Fibonacci retracement in crypto trading, providing insights that not only clear up confusion but also empower traders to make better-informed decisions.

The significance of Fibonacci retracement in recognizing potential reversal levels is a powerful tool available to traders. In a market as volatile as cryptocurrency, leveraging such indicators can contribute to maximizing profits and minimizing losses. With a growing number of Vietnamese traders embracing cryptocurrencies, the application of Fibonacci retracement becomes increasingly relevant.

Understanding Fibonacci Retracement Levels

Before jumping into trading strategies, it’s crucial to grasp the concept of Fibonacci retracement levels. These levels are horizontal lines that indicate possible support or resistance levels based on the Fibonacci sequence.

- Fibonacci Sequence: The sequence begins with 0 and 1, and subsequent numbers are derived by adding the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, …).

- Retracement Levels: Key levels derived from the sequence are 23.6%, 38.2%, 50%, 61.8%, and 100%.

This tool helps traders predict potential price reversals by identifying key points where buyers and sellers may step in.

How to Utilize Fibonacci Retracement in Your Trading

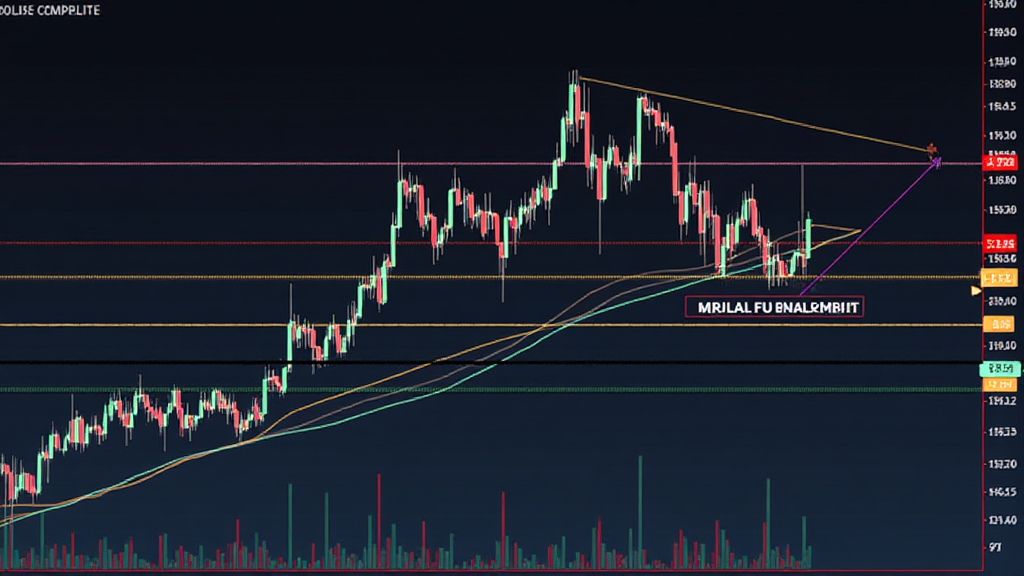

Here’s the catch: using Fibonacci retracement levels is not just about drawing lines on a chart. It’s about aligning these levels with your trading strategy. Here’s how:

- Select a Significant Price Movement: Choose a recent high and low on a price chart.

- Draw the Fibonacci Levels: Apply the Fibonacci retracement tool from the high to the low for downtrends, or vice versa for uptrends.

- Observe Price Action: Watch for price reactions at these levels. Look for confirming signals such as candlestick patterns or volume increases.

- Set Buy/Sell Orders: Use identified levels as potential points for placing buy/sell orders.

By effectively employing these levels, traders can enhance their entry and exit strategies, substantially improving their success rates.

Common Mistakes When Using Fibonacci Retracement

Even seasoned traders can fall into traps when using Fibonacci retracement. Common mistakes to avoid include:

- Ignoring Market Context: Always consider the overall market trend before making decisions based on Fibonacci levels.

- Over-Reliance on Levels: While useful, these predictions are not foolproof; incorporate other indicators for confirmation.

- Neglecting Risk Management: Ensure that stop-loss orders are placed to protect against unexpected downturns.

Fibonacci Retracement and the Vietnamese Crypto Market

As of 2025, Vietnam has seen a staggering growth rate in cryptocurrency adoption, which has reached over 106% in user engagement. This statistic highlights the importance of applying tools like Fibonacci retracement in a rapidly evolving market.

The understanding of traditional market analysis is crucial for Vietnamese traders who navigate both local and global cryptocurrency markets. Learning from real market behavior can lead to significant profits if executed correctly.

Using Fibonacci Retracement Alongside Other Tools

For a holistic trading strategy, integrate Fibonacci retracement with other technical indicators such as:

- Moving Averages: Combine Fibonacci levels with moving averages to confirm potential support/resistance areas.

- Relative Strength Index (RSI): Use RSI to determine if the market is overbought or oversold in conjunction with Fibonacci levels.

- MACD Indicator: The Moving Average Convergence Divergence indicator can help identify potential reversals that align with Fibonacci retracement levels.

When these tools converge on the same price level, it provides a powerful signal for traders to act upon.

Wrap Up

In conclusion, Fibonacci retracement offers a structured approach for traders in the volatile cryptocurrency market, providing insight for potential entry and exit points. By understanding how to apply these levels and avoiding common pitfalls, traders can elevate their strategies and yield better outcomes. Whether you are a novice or an experienced trader, integrating Fibonacci retracement into your strategy can bring substantial benefits. For those operating in the Vietnamese market, embracing these practices is not just beneficial but essential in mastering the trading game.

As we move into 2025, it’s important to stay informed about industry innovations. Remember, always consult with local regulators when making trading decisions. Not financial advice.

Explore more about cryptocurrency strategies at hibt.com.

Author: John Dias – A seasoned blockchain analyst and author of over 30 publications in the field, he has led audits for major projects and offers insights into advanced trading strategies.