USDT Market Dominance 2026: A Deep Dive into Digital Currency Trends

As we gaze into the future of cryptocurrency, one question resonates in the minds of many traders, investors, and enthusiasts alike: What will the USDT market dominance look like in 2026? With the ever-evolving landscape of digital assets, understanding the factors that contribute to the dominance of Tether (USDT) is crucial for navigating this volatile market.

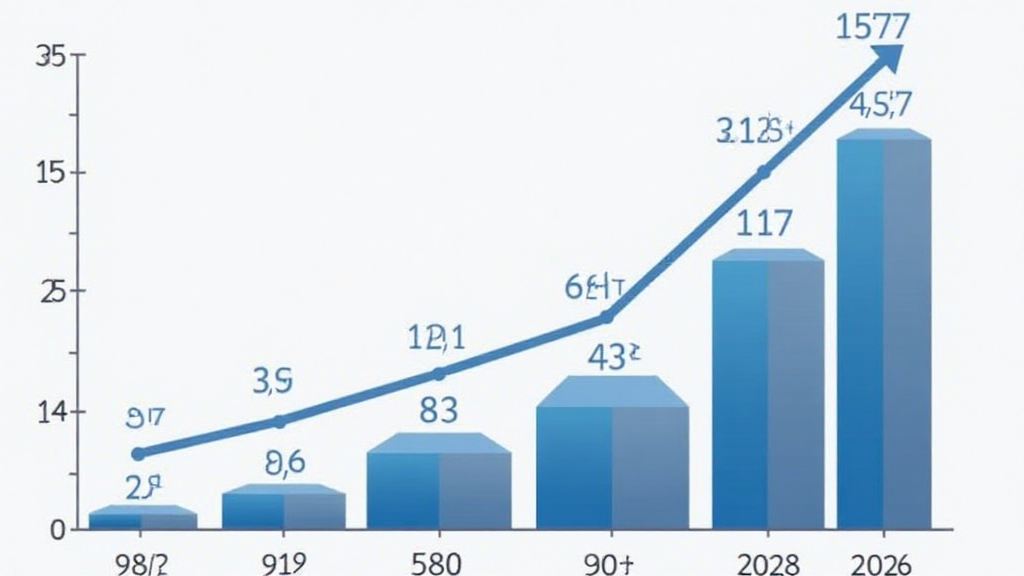

The Growth of USDT in the Cryptocurrency Market

In recent years, Tether has emerged as one of the leading stablecoins, primarily acting as a medium of exchange in the cryptocurrency ecosystem. According to data from hibt.com, USDT accounted for nearly 70% of the total stablecoin market as of 2023. But what drives this dominance?

ong>Liquidity: ong> USDT provides exceptional liquidity and is widely accepted across-3/”>cross numerous exchanges.ong>Stability: ong> Being pegged to the US dollar, USDT offers a reliable store of value for traders, especially during market fluctuations.ong>Adoption: ong> The rapid increase of DeFi and trading activities has spurred demand for USDT.

Current USDT Market Dynamics

As of mid-2023, the market capital of USDT was approximately $83 billion, positioning it as a cornerstone in the crypto trading ecosystem. This was largely due to:

- Increased institutional adoption of cryptocurrencies.

- Emerging markets growing their crypto user base significantly, particularly in regions like Vietnam, where local demand surged by 40% in just a year.

Factors Influencing USDT’s Market Dominance by 2026

To predict USDT’s market dominance in 2026, it helps to consider various influential factors.

ong>Regulatory Environment: ong> Compliance with regulations will likely determine the resilience of stablecoins. As countries like Vietnam tighten their cryptocurrency regulatory frameworks, USDT could either thrive or face challenges.ong>Technological Advances: ong> Innovations in blockchain technology, especially concerning scalability and transaction speed, will affect how stablecoins operate.ong>Global Economic Climate: ong> With potential inflationary pressures and fiat instability, more investors may turn to stablecoins as a refuge.

Potential Risks to USDT’s Market Position

While USDT shows promising potential, several risks could threaten its market dominance:

ong>Competitors: ong> New entrants in the stablecoin market, such as USDC and DAI, are gaining traction, potentially eroding USDT’s market share.ong>Legal Issues: ong> Tether has faced scrutiny and legal challenges regarding its backing and operational methods.ong>Market Sentiment: ong> Any negative sentiment or controversy surrounding USDT could lead to a loss of trust among users.

Predictions for USDT Market Dominance in 2026

Based on various market analyses, several scenarios could unfold by 2026 concerning USDT’s dominance:

ong>Optimistic Scenario: ong> If USDT can maintain its operations without legal or regulatory issues, it could grow its market share up to 80% among stablecoins.ong>Stable Scenario: ong> USDT remains the leading stablecoin, holding around 70% of the market.ong>Pessimistic Scenario: ong> Increasing competition and regulatory burdens could reduce its market share to below 60%.

Conclusion: Navigating the Future of USDT

In summary, the trajectory of USDT market dominance by 2026 hinges on numerous factors, from regulatory frameworks to technological advancements and competition. As the landscape evolves, staying educated and agile in this space will be crucial for traders and investors.

Preparing for the future means constantly analyzing market trends, understanding regional dynamics, such as the growing Vietnamese user base, and adapting strategies accordingly. It’s vital to consider the essential question: How will you navigate the changing tides of digital assets?

The journey of understanding USDT’s market dominance is just beginning—make sure to stay informed with reliable sources like hibt.com and engage with communities that align with your cryptocurrency interests.

To wrap it up, the evolution of the USDT market dominance is a fascinating journey ahead. By 2026, it could be a completely different landscape, and being well-prepared will be your best strategy.